Real Estate Investors Made over $1.7M on Their Fix and Flips

By Getting COACHING From Us: $100M Real Estate Investors

(Exclusively for MOTIVATED real estate investors who are READY to pursue FINANCIAL FREEDOM)

How Lauren Made 💰 $160K 💰 on Her First Fix And Flip after joining the Accelerator Program

How Tien Made 🤑 $100K 🤑 On a Single Flip By Knowing How to Find Distressed Assets

How Ola Achieved 💰 Six-Figure Success 💰 With Her First Deal After Joining Accelerator

How Horace Made 💰 $88K 💰 on His First Fix And Flip after joining the Accelerator Program

How Richard Got a 📈

10X RETURN ON INVESTMENT

📈 from joining the Accelerator Program

How Joel Became a 💰 MILLIONAIRE 💰 With Help From the Clear Sky Team

How Tien 📈 BREACHED HER FINANCIAL GOAL 📈 with the Clear Sky Team

How Keith Made a Decision to ⌚️ TAKE ADVANTAGE OF HIS TIME ⌚️ To Pursue Financial Freedom

Meet Your Mentors

Charlie Einsmann

Sam Jacknin

Ed Grass

Charlie Einsmann, Sam Jacknin and Ed Grass started their careers in cubicle hell. Like you, they were born with ZERO real estate investing experience. They learned through patience, trial and error and built their business to $100M in assets. Now they're sharing everything they know, so you can do the same. They founded Clear Sky Properties, LLC in 2005 and Clear Sky Financial, LLC in 2013. They've flipped over 400 houses and own a portfolio of more than 50 rental properties.

In Our ACCELERATOR Program, You'll Get 1-on-1 Mentorship From $100M Real Estate Investors

Endorsed By These Organizations

Are You Ready To Join Our Community?

In Our ACCELERATOR Program, You'll Learn to Find Off-Market DISTRESSED ASSETS – Profitable Deals, Without the Risk

REAL ESTATE INVESTORS:

Are You Looking to QUICKLY Learn How to Find Distressed Assets And Profitable Deals in Just 90 Days?

Click the Button Below For Your Chance to Join the Most Valuable Resource for Building Financial Freedom on Planet Earth.

Frequently Asked Questions

What is the Accelerator Program?

In our Accelerator Program, we work directly with you to help you find distressed assets. We teach you the same strategies that we used to build our business to over $100M in assets. We guide you through your investment decisions, and help you execute on your investments – whether you're wholesaling, flipping, or holding.

The Accelerator Program is a combination of education, coaching and community to help you build wealth in residential real estate.

How do I learn more about the Accelerator Program?

Click any of the green buttons on this page to schedule a free Zoom call with our team. This program involves direct mentorship, and everything is customized based on your needs.

When you schedule a call, make sure you pick a time where you can be on camera, in a quiet place, to give your full focus.

What can I expect on the Zoom call to learn more about the Accelerator Program?

After you book the Zoom call, you'll receive a confirmation email with specific details on how to prepare.

On the Zoom call, we'll do a deep dive into your real estate investing business, to determine where you are, and where you want to go. We'll get clear with you on your goals. If it makes sense for us to help you, and you're motivated, we'll come up with a game plan to help you reach your goals. Then we'll talk about next steps for potential enrollment.

I'm a beginner/intermediate/advanced real estate investor. Will the Accelerator Program work for me?

The Accelerator Program will benefit residential real estate investors at all skill levels. However, we only work with MOTIVATED individuals who have the RELENTLESS DRIVE to succeed. It you're not that person, then don't bother scheduling a call.

Should I wait for the market to go up or down before I get serious about real estate investing?

Successful investors don’t wait for the market to dictate their strategy. They focus on buying the right property at the right price. Distressed assets, in particular, provide opportunities in every phase of the real estate cycle.

In a rising market, distressed properties can still be acquired below market value due to unique seller situations: divorce, inheritance, financial hardship, or foreclosure timelines.

In a declining market, distressed opportunities often become even more abundant as financial pressures increase on owners.

This is why timing the market isn’t nearly as important as learning how to consistently identify and secure discounted properties. Your profit comes from entering the deal at a price well below the true value, regardless of broader market conditions.

The key advantage of focusing on distressed assets is that you are not relying on market appreciation to make money. Instead, you’re building a repeatable process that generates opportunities whether the market is expanding, contracting, or staying flat.

In other words, the best time to learn how to invest in distressed properties is now. By building these skills today, you position yourself to capitalize on opportunities in any market environment.

I'm not interested in fix and flips. I'm interested in buying and holding rental properties. Will the strategy of buying distressed assets work for me?

Absolutely. In fact, acquiring distressed properties is a critical advantage for anyone serious about building long-term wealth as a buy and hold investor.

When you secure a distressed asset, you are able to purchase at a significant discount to market value, giving you substantial built-in equity from the very beginning. This equity is one of the strongest wealth-building tools available, providing a financial buffer and improving your investment returns immediately.

On the other hand, choosing not to buy distressed assets and instead purchasing rentals at or near retail market value puts you at a significant disadvantage.

Without that initial equity cushion, you have less protection against market downturns, reduced cash flow opportunities, and a much slower path to accumulating wealth. In most cases, you would be relying primarily on gradual mortgage paydown and the hope of future appreciation, which can take years or even decades to have a meaningful impact.

By focusing on distressed properties, you are not merely acquiring cash flow but establishing a foundation for accelerated equity growth and true financial leverage. For long-term real estate investors, this approach is essential to building a resilient, scalable portfolio that outpaces more conventional buy and hold strategies. Choosing to ignore distressed deals means giving up one of the most reliable and proven paths to growing wealth through rental properties.

You are teaching all your students how to find distressed assets. Doesn't that mean there will be a lot of competition, making it hard for me to find deals myself?

No, having many students does not mean you will be competing for the exact same distressed properties.

The concern that too many investors makes it impossible to find unique deals is a misconception. Real estate investing is not a zero-sum game because the number of distressed asset opportunities is constantly changing and expanding, and the strategies you learn here are designed to help you build your own distinct path to finding deals.

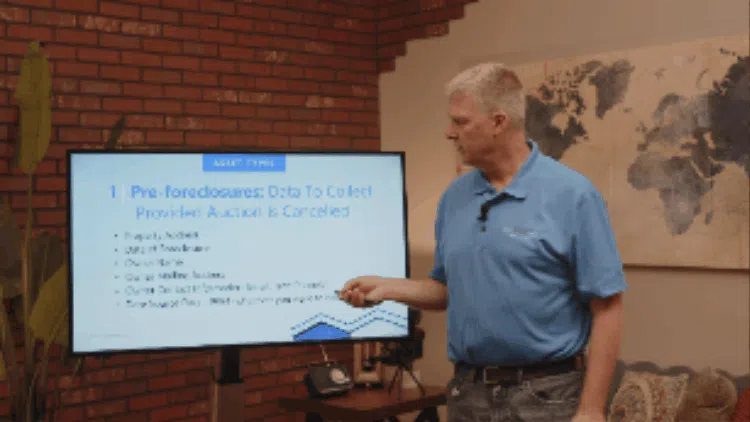

This program teaches you how to develop your own lead sources and create personalized systems for uncovering distressed assets that are unique to your background, network, and chosen markets. While some students might focus on pre-foreclosures, others build their business around tax liens, probate properties, or hyper-local neighborhoods. You are not following a single blueprint; you are learning how to generate your own lists, set up specialized marketing, and establish a niche that others are not targeting.

For instance, one student might find success by driving for dollars and spotting vacant homes in a specific area, while another consistently sources leads from professional connections like attorneys or accountants. Even in the same county, it is rare for two students to be working identical leads. Most opportunities arise from individual effort, creativity, and the local relationships you build.

By prioritizing skill-building and marketing consistency, you are equipped to stand out in any market. Rather than increasing competition, the approach in this program expands the universe of opportunity. Real estate is full of untapped sources and overlooked deals for those with the methods and persistence to find them. The strategies taught here make it possible for every student to succeed independently, regardless of how many others are learning alongside them.

These Real Estate Investors Became MILLIONAIRES by Implementing Our Strategies

"I set a 10-year financial goal. Charlie and the Clear Sky Team helped me reach that in a year and a half." - Tien C.

"I knew zero about real estate. Now I've done over 20 deals, including 10 rentals. Charlie and Sam are the most genuine mentors out there." - Joel C.

Learn How You Can Get Coaching From Us: $100M Real Estate Investors